jersey city property tax abatement

In 1999 Jersey City. Abatements can only be granted once a penalty has been assessed and the taxpayer is notified billed.

Peek Inside Park And Shore Jersey City S Ultra Luxury Condo Development Luxury Condo Apartment Interior House Prices

Jersey City Mayor Steven Fulop has announced that the city will move forward with the termination of a tax abatement for four of the six buildings within The Beacon Community at 20 Beacon Way.

. New Construction w Summer delivery. A Jersey City ordinance that says developments granted property tax abatements must hire union labor on their projects was struck a blow last week by an Appeals Court although the citys top official says the matter is far from settled. APPLICATION FOR REAL PROPERTY TAX ABATEMENT FOR RESIDENTIAL PROPERTY IN AN URBAN ENTERPRISE ZONE CHAPTER 207 PUBLIC LAWS 1989 as amended.

A request for abatement must be in writing. Of comparatively high property tax rates in New Jersey abatements can be a valuable incentive for developers involving hundreds of millions of dollars in abated taxes on billions of dollars of property across the state. Zillow has 16 homes for sale in Jersey City NJ matching 5 Year Tax Abatement.

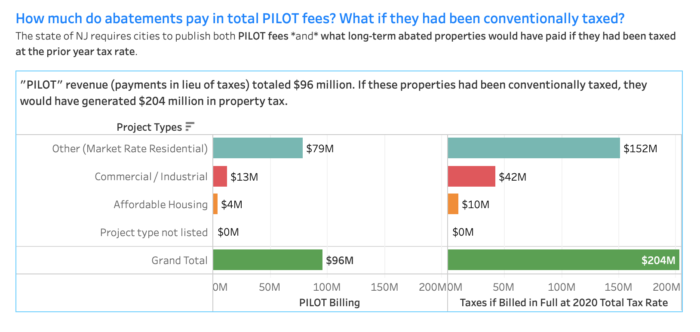

The City Council will introduce an ordinance revoking a 20-year tax abatement on a five-story residential building under construction at 305 West Side Ave. City of Jersey City. Jersey City abatements have historically sent 95 of the PILOT fees to the city 5 to the county and 0 to the schools.

New Jersey Property Tax Benefits. All owners pay only a small 165 of the purchase price in annual property taxes in lieu of the standard Jersey City Property tax. New Yorkers gain several forms of relief from NYC property tax thanks to a mix of tax abatement programs like the J51 Tax Abatement the Cooperative and Condominium Abatement the Green Roof Abatement the Solar Roof.

The legal fight which has waged for over two years pertains to Section 304 of Jersey Citys Municipal. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. It cannot be granted in person by phone or through email.

February 5 2020 816 am. Property Tax Abatements in Jersey City a highly critical report of Jersey Citys abatements. Coming Soon - Downtown Jersey City just a short walk to the PATH Train.

Background the Sugar House Abatement. Situated high in the sky on the 22nd floor of Downtown Jersey Citys best full-service building this two-bed two-and-a-half-bath home offers every luxury amenity including a private balcony. 5227H-60 et seq and shall include the entire area withi n.

Reena Rose Sibayan The. While schools receive a portion of regular property tax they do not receive any of the PILOT fees. Tax Abatement for Jersey City Property.

25 Hudson Street Jersey City NJ 07302 201 433-1800. Urban Enterprise Zone Property Tax Abatement. All Liberty Terrace units have been granted a 20-year tax abatement starting in 2006.

The tax abatement applies to both original and resold units. This the most direct impact that abatements have on our schools but more is explained below. Jersey City officials plan to audit the citys hundreds of Payment in Lieu of Taxes agreements following a Board of.

Please also email JSISKJCNJORG for confirmation of the ACH and of any changes made to the Banking Account to be debited. The Jersey City Housing Authority JCHA was formed in 1938 to provide decent affordable housing for low-income families seniors and persons with disabilities. Unit 2201 totals nearly 1500 square feet of open-concept living with sweeping city and river views while the benefit-rich building also offers a tax abatement for homeowners.

Mayor Steve Fulop announced Monday recovering 23 million from a developer who failed to make payments to the city as part of a tax abatement agreement. JCHA is New Jerseys second largest public housing authority serving over 15000 residents. TAXES PAYMENT 000 4035 000 0 000.

Online Inquiry Payment. It has provided the Purchaser with true correct and complete copies of the Financial Agreement and all other. New Jersey Policy Perspectives NJPP All That Glitters Isnt Gold.

You should send your request for abatement to the address listed on your billing notice. Pursuant to the New Jersey Urban Enterprise Zones Act PL1983 c. We are responsible for the administration of approximately 7100 housing units.

This law provides for five-year tax abatements to existing and newly constructed residential properties and non-residential structures converted to residential use in. Checking Account Debit - Download complete and send the automated clearing house ACH Tax Form to JC Tax Collector 280 Grove Street Jersey City NJ 07302. To request abatement you must submit the following.

JERSEY CITY NJ 07302 Deductions. 5 year property tax abatement. Jersey City will be providing up to 10000 in rental assistance to low-income families who have been severely affected by the pandemic Mayor Steve Fulop and the Jersey City Housing Authority.

View listing photos review sales history and use our detailed real estate filters to find the perfect place. Urban Enterprise Zones UEZs are created with the goal of stimulating economic activity in distressed areas. While abatement of taxes otherwise owed is uniformly positive from the perspective of the.

Jersey Citys new mayor says the city recovered millions of dollars in years of uncollected taxes from a Jersey City developer. Jersey Citys counter-point response to the NJPP report titled Tax Abatements in Jersey City A Vehicle for Growth and Prosperity.

A New Study Revives The Debate Over Property Tax Abatements

Jersey City Property Tax Appeals A Civic Step By Step Overview Civic Parent

Tax Abated Apartment Building Complex Was Being Operated As Hotel Jersey City Officials Say Nj Com

Infographic Jersey City Tax Base Tax Levies And Tax Rates Demystified Civic Parent

New Offshore Tax Haven Report Offshore Tax Haven Tax

Map See Where Jersey City Hands Out Tax Abatements Nj Com

New Jersey Education Aid Why Jersey City S New Unpiloted Skyscraper Will Help Taxpayers Not Necessarily The Public Schools

In One Chart Jersey City S Seismic Change In Tax Levies Fully Funds The Schools And Reallocates Property Tax Civic Parent